Tooling Depreciation . ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Proceeds before intended use (amendments to ias 16) which. in selecting a method of depreciation for a given asset, the factors to consider include whether (1) the asset is subject to rapid. this guidance indicates that design and development costs related to products to be sold should be expensed as incurred,. 40 rows tooling (for drills, lathes, mills etc) 3 years. in may 2020, the board issued property, plant and equipment:

from cryptolisting.org

ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Proceeds before intended use (amendments to ias 16) which. in may 2020, the board issued property, plant and equipment: this guidance indicates that design and development costs related to products to be sold should be expensed as incurred,. in selecting a method of depreciation for a given asset, the factors to consider include whether (1) the asset is subject to rapid. 40 rows tooling (for drills, lathes, mills etc) 3 years.

5 Steps to Calculate Units of Production Depreciation Coinranking

Tooling Depreciation in may 2020, the board issued property, plant and equipment: this guidance indicates that design and development costs related to products to be sold should be expensed as incurred,. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Proceeds before intended use (amendments to ias 16) which. ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. 40 rows tooling (for drills, lathes, mills etc) 3 years. in may 2020, the board issued property, plant and equipment: in selecting a method of depreciation for a given asset, the factors to consider include whether (1) the asset is subject to rapid.

From www.thestreet.com

Currency Depreciation vs. Appreciation Definitions & Examples TheStreet Tooling Depreciation this guidance indicates that design and development costs related to products to be sold should be expensed as incurred,. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. in may 2020, the board issued property, plant and equipment: ias 16, property, plant and equipment, requires entities to review the. Tooling Depreciation.

From haipernews.com

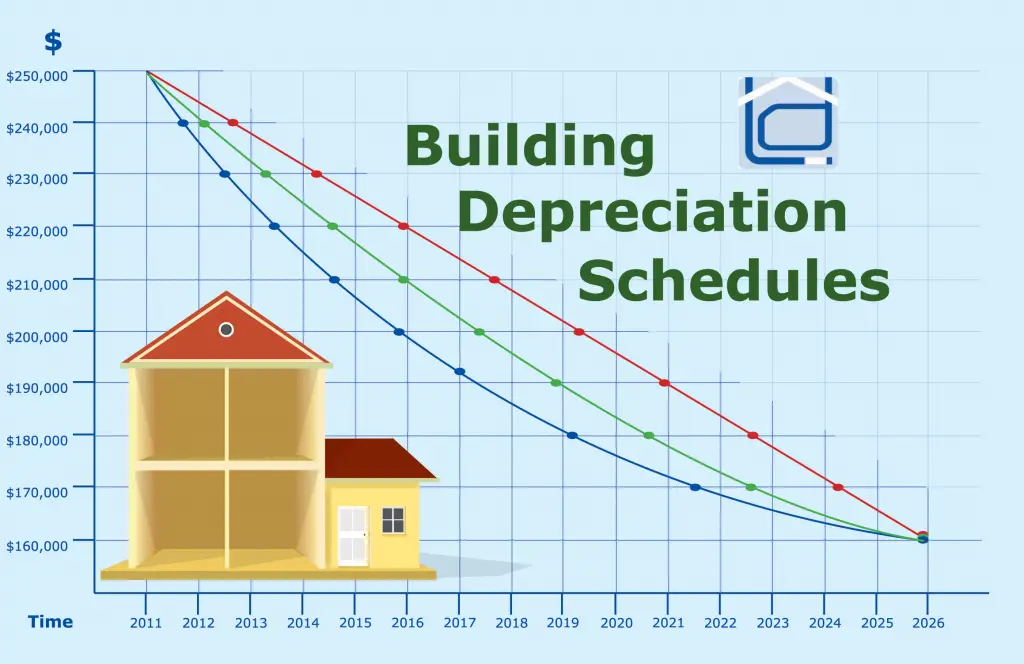

How To Calculate Depreciation For Building Haiper Tooling Depreciation this guidance indicates that design and development costs related to products to be sold should be expensed as incurred,. Proceeds before intended use (amendments to ias 16) which. in selecting a method of depreciation for a given asset, the factors to consider include whether (1) the asset is subject to rapid. ias 16, property, plant and equipment,. Tooling Depreciation.

From cryptolisting.org

5 Steps to Calculate Units of Production Depreciation Coinranking Tooling Depreciation in may 2020, the board issued property, plant and equipment: this guidance indicates that design and development costs related to products to be sold should be expensed as incurred,. in selecting a method of depreciation for a given asset, the factors to consider include whether (1) the asset is subject to rapid. depreciation is the systematic. Tooling Depreciation.

From cardioworkouts.github.io

How To Calculate Depreciation Equipment A Beginner s Guide Cardio Tooling Depreciation in selecting a method of depreciation for a given asset, the factors to consider include whether (1) the asset is subject to rapid. ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. this guidance indicates that design and development costs related to products to be sold should be. Tooling Depreciation.

From www.scribd.com

Depreciation PDF Depreciation Investing Tooling Depreciation in may 2020, the board issued property, plant and equipment: ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. this guidance indicates that design and development costs related to products to be sold should be expensed as incurred,. in selecting a method of depreciation for a given. Tooling Depreciation.

From forestrypedia.com

Depreciation Tooling Depreciation this guidance indicates that design and development costs related to products to be sold should be expensed as incurred,. Proceeds before intended use (amendments to ias 16) which. 40 rows tooling (for drills, lathes, mills etc) 3 years. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. ias 16,. Tooling Depreciation.

From moneysmint.com

What Is Depreciation? Definition, Types, Example & Purpose Tooling Depreciation 40 rows tooling (for drills, lathes, mills etc) 3 years. Proceeds before intended use (amendments to ias 16) which. ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. in selecting a. Tooling Depreciation.

From napkinfinance.com

What is Depreciation? Napkin Finance Tooling Depreciation ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. in may 2020, the board issued property, plant and equipment: depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. 40 rows tooling (for drills, lathes, mills etc) 3 years. Proceeds before. Tooling Depreciation.

From www.youtube.com

Depreciation Related Entries Depreciation on Fixed Assets WDV Tooling Depreciation this guidance indicates that design and development costs related to products to be sold should be expensed as incurred,. in may 2020, the board issued property, plant and equipment: in selecting a method of depreciation for a given asset, the factors to consider include whether (1) the asset is subject to rapid. Proceeds before intended use (amendments. Tooling Depreciation.

From www.awesomefintech.com

Annuity Method of Depreciation AwesomeFinTech Blog Tooling Depreciation 40 rows tooling (for drills, lathes, mills etc) 3 years. in may 2020, the board issued property, plant and equipment: Proceeds before intended use (amendments to ias 16) which. in selecting a method of depreciation for a given asset, the factors to consider include whether (1) the asset is subject to rapid. ias 16, property, plant. Tooling Depreciation.

From www.freepik.com

Premium Vector Four main type of depreciation methods to calculate Tooling Depreciation Proceeds before intended use (amendments to ias 16) which. ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. this guidance indicates that design and development costs related to products to be sold should be expensed as incurred,. in may 2020, the board issued property, plant and equipment: Web. Tooling Depreciation.

From studylib.net

A Depreciation Guide for Tooling and Machining Company Tooling Depreciation ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. this guidance indicates that design and development costs related to products to be sold should be expensed as incurred,. 40 rows tooling (for drills, lathes, mills etc) 3 years. depreciation is the systematic allocation of the depreciable amount. Tooling Depreciation.

From www.studocu.com

Depreciation by the Fixed Percent Method The effect is to create Tooling Depreciation this guidance indicates that design and development costs related to products to be sold should be expensed as incurred,. 40 rows tooling (for drills, lathes, mills etc) 3 years. in may 2020, the board issued property, plant and equipment: depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Proceeds. Tooling Depreciation.

From www.scribd.com

DEPRECIATION PDF Depreciation Book Value Tooling Depreciation in selecting a method of depreciation for a given asset, the factors to consider include whether (1) the asset is subject to rapid. in may 2020, the board issued property, plant and equipment: this guidance indicates that design and development costs related to products to be sold should be expensed as incurred,. ias 16, property, plant. Tooling Depreciation.

From fgeerolf.com

Investment Tooling Depreciation in selecting a method of depreciation for a given asset, the factors to consider include whether (1) the asset is subject to rapid. ias 16, property, plant and equipment, requires entities to review the residual value, useful life, and depreciation method. in may 2020, the board issued property, plant and equipment: this guidance indicates that design. Tooling Depreciation.

From www.tranquilbs.com

What is Asset Depreciation? What are the Different Types Tooling Depreciation depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. Proceeds before intended use (amendments to ias 16) which. in may 2020, the board issued property, plant and equipment: in selecting a method of depreciation for a given asset, the factors to consider include whether (1) the asset is subject to. Tooling Depreciation.

From www.studocu.com

Depreciation Methods n/a What are the Main Types of Depreciation Tooling Depreciation Proceeds before intended use (amendments to ias 16) which. this guidance indicates that design and development costs related to products to be sold should be expensed as incurred,. in may 2020, the board issued property, plant and equipment: depreciation is the systematic allocation of the depreciable amount of an asset over its useful life. in selecting. Tooling Depreciation.

From tipmeacoffee.com

Depreciation Definition and Types, With Calculation Examples Tooling Depreciation 40 rows tooling (for drills, lathes, mills etc) 3 years. in may 2020, the board issued property, plant and equipment: Proceeds before intended use (amendments to ias 16) which. in selecting a method of depreciation for a given asset, the factors to consider include whether (1) the asset is subject to rapid. ias 16, property, plant. Tooling Depreciation.